For patients considering brachioplasty before the age of retirement, early compassionate release of superannuation funds can be a challenge. If the procedure is deemed medically necessary, however, accessing these funds may be possible if strict criteria are met.

Book your appointment online now

A superannuation fund, AKA super fund, is money that both an employee and employer contribute towards retirement. In most cases, an employee’s funds can only be accessed at the time of retirement, generally between the ages of 55-60 in Australia. However, it may be possible to access this money earlier under certain circumstances.

Over the years, patients have considered applying for early access to their super funds to cover the cost of brachioplasty (arm lift) surgery, though it can be quite challenging. One way to access these funds early is to apply for a release of superannuation funds on compassionate grounds if the surgery is deemed medically necessary and meets specific conditions set forth by the ATO (Australian Taxation Office). This process can seem daunting to patients unfamiliar with the system. Don’t worry. If you are interested in applying for early release of your super funds for brachioplasty (arm lift) surgery, I suggest booking a consultation with me so I can walk you through the entire process. During this session, I will explain who qualifies, how to apply, review what documentation is needed for early release of super funds, and hopefully, make it all seem a lot less overwhelming.

What is Brachioplasty Surgery (Arm Lift) Surgery?

Brachioplasty, commonly known as arm lift, is a surgical procedure to remove excess and redundant skin tissue from the upper arm. A study on brachioplasty surgery explains it as “[t]he excision of excess skin and lipodystrophy of the upper arm, which can extend onto the lateral chest wall.”

Brachioplasty is a standard procedure after massive weight loss, pregnancy, and brachial laxity due to ageing that helps ** ** skin and ** functionality. Different brachioplasty procedures are available, depending on the amount of skin and fat tissue, the patient’s age, and the patient’s goals, among other things. Variations in arm lift surgery affect the scar placement, extensiveness, and length. During our consultative session, I will assess the degree of skin laxity, determine the best approach, and make a suggestion as to the procedure that will suit you best.

For patients with stubborn arm fat that will not go away despite diligent efforts involving diet and exercise, brachioplasty can be combined with other procedures like VASER liposuction.

What is a Superannuation Fund (AKA Superfund or Super)?

A superannuation fund, also known as a super fund or super, is money an employee and the employer contribute towards the employee’s retirement. Generally, the employer matches the employee’s contributions, and the funds can be accessed upon retirement. The Australian Taxation Office (AOT) offers a wide variety of retirement fund that can be tailored to fit every situation, whether a person is an employee, self-employed, or independent contractor.

Common types of super funds include industry funds, retail funds, defined benefit fund, public sector funds, corporate fund, and SMSFs (self-managed) super funds.

Regardless of the type of fund or employment status, in most situations, the funds can only be accessed at the time of retirement. However, the Australian Taxation Authority (ATO) regulations allow for a compassionate early release of super funds in situations of severe hardships or medical necessity.

Early Access to Superannuation Fund

Eligibility Criteria

To access your superannuation on compassionate grounds, you must demonstrate that you need the funds for one of the following reasons:

- Medical Treatment and Transport:

- To pay for medical treatment or transport for yourself or a dependent.

- The treatment is not available through the public health system and no public sector funds too.

- Mortgage Assistance:

- To prevent the foreclosure of your home by paying overdue mortgage payments.

- Modifications to Your Home or Vehicle:

- To modify your home or vehicle to accommodate the special needs of yourself or a dependent due to a severe disability.

- Palliative Care:

- To pay for palliative care if you or a dependent is terminally ill.

- Funeral Expenses:

- To cover the cost of funeral or burial expenses for a dependent.

- Care for a Severe Disability:

- To pay for care services for a severe disability for yourself or a dependent.

To access superannuation funds on the grounds of financial hardship, you must contact your super fund provider. The amount you receive should be between $1,000 and $10,000 and only attract normal taxes, with no special taxes applied.

The eligibility criteria will depend on your preservation age in relation to your current age. The preservation age is the age when an individual can retrieve their super contributions.

If you are below 55 years and 39 weeks and your preservation age is 55, the eligibility criteria are:

- Applicant received continuous support payments from the government for 26 weeks

- Applicant cannot afford their current living expenses

If you are past the preservation age, the eligibility criteria are:

- Applicant continuously received support payments from the government for at least 39 weeks after attaining the preservation age

- Applicant is not gainfully employed during the time of application

Application Process

- Gather Documentation:

- Obtain relevant documents to support your application, such as medical certificates, invoices, or mortgage statements.

- Submit Application:

- To submit your application to the Australian Taxation Office (ATO) through their online services, you will need to create or log into your myGov account linked to the ATO.

- Fill out the application form and attach all necessary supporting documents.

- Wait for Approval:

- The ATO will review your application and determine if you meet the criteria for early release of superannuation on compassionate grounds.

- If approved, the ATO will provide you with a certificate of release. You will then apply directly to your superannuation fund, which will then arrange the release of your funds.

- Receive Funds:

- Your superannuation fund will transfer the approved amount to your nominated bank account.

Important Considerations

- Tax Implications: Withdrawals may be subject to tax, and it’s essential to understand the tax implications of accessing your superannuation assets early, so it’s important to seek professional advice.

- Impact on Retirement Savings: Withdrawing your pension fund early can significantly impact your retirement savings, so consider seeking financial advice from a financial advisor before proceeding.

For more detailed information and to access the application forms, visit the Australian Taxation Office website.

Book your appointment online now

Using Superannuation Fund to Cover Brachioplasty Surgery (Arm Lift) Surgery

You can use superannuation funds to cover brachioplasty (arm lift) surgery on compassionate grounds if the procedure is deemed a medical necessity. ATO doesn’t allow early release of super funds to fund cosmetic procedures.

To prove that the condition is medically necessary, you must show that it interferes with the body’s normal functioning and causes acute or chronic pain. Therefore, treatment is essential to ** or ** the body’s normal functioning. Additionally, you must get a referral from a GP (General Practitioner) and a specialist surgeon to prove medical necessity.

Criteria For Accessing Superannuation Funds for Brachioplasty (Arm Lift) Surgery

To apply for the early release of your existing super fund for brachioplasty, you must meet the following criteria:

- You experience acute/chronic pain resulting from the excess skin.

- Medical treatment is not readily available in the public health system.

Acute/ Chronic Pain Resulting from the Excess Skin

Excess ** skin on the upper arm may result in rashes or chafing as the skin rubs against each other, resulting in wounds, infections, and chronic pain. Therefore, brachioplasty surgery is essential to ** the body’s normal functioning.

A study on brachioplasty notes, “[e]xcess skin and ptosis can result in functional problems such as intertrigo, poor hygiene, infections, and psychosocial morbidity.” It further notes that “[b]ody contouring procedures, including brachioplasty following bariatric surgery, ** **, function, and ** and reduces BMI, and aid weight loss.”

Medical Treatment is Not Readily Available in the Public Health System

In addition to proving medical necessity, you must ensure the surgical procedure to treat the condition is not readily available in public hospitals. Arm lift surgery (brachioplasty) is not readily available in public hospitals.

What to Know Before Applying for Early Release of Superannuation Funds for Brachioplasty (Arm Lift) Surgery

Before you apply for early release of superannuation funds for Arm Lift surgery, consider the following:

Apply Before Undergoing Surgery

If you qualify for early compassionate release of super funds, applying before undergoing the procedure is always important. This is because there is no guarantee that the funds will be released.

It May Take Several Weeks Before Approval

Approval for early release of super funds takes time, (approximately 4 weeks at a minimum) because the agency needs to review the documents before making a decision. After ATO approval, you must contact your super fund to release the money. Different corporate funds have different turnaround times when releasing funds for compassionate grounds, with some operating faster than others.

Every Super Fund Operates Differently

In addition, super funds have differing rules regarding the amount of funds that can be withdrawn on compassionate grounds.

I always advise my patients to compare super funds and switch to a different one if their preferred fund doesn’t offer early compassionate superannuation funds.

Ensure There are Enough Funds in the Super Account

Before applying for a claim, ensure that your super balance is enough to cover the corresponding taxes and the surgical expense.

There May be Fees Involved, Depending on the Superannuation Fund

In addition to a withholding tax that will be applied to the amount of withdrawal, some industry super funds charge special fees on funds released early, which are deducted from account balances.

Financial Consequences Should be Taken into Consideration

Withdrawing your super funds early means you’ll have less or no funds to utilise upon retirement. Additionally, it will affect your protection from creditors in the event of a bankruptcy.

Funds Released Can be Utilised for You or a Dependent

ATO allows you to utilise the funds for your expenses or those of a qualifying dependent. You must specify the name of the beneficiary on the application.

You Must Be a Citizen or Permanent Resident of Australia or New Zealand

It’s important to note that eligibility also depends on citizenship and permanent residence. Temporary residents are not eligible.

Process for Early Compassionate Release of Superannuation Funds

When my patients meet with me about undergoing brachioplasty using an early compassionate release of their superannuation funds, I explain, in detail, the steps involved. As this is a very strict and somewhat tedious process, I try to do everything I can to offer my guidance to make it somewhat less overwhelming.

Step 1: Contact/Check your Superannuation Fund’s Website

Every super fund operates with different rules regarding the early release of funds on compassionate grounds. Thus, the first step is understanding how your industry fund operates. You can check the super fund’s website or contact them directly. Note that you can switch to another super fund if your current one doesn’t allow early release of funds on compassionate grounds.

Step 2: Gather Supporting Documents and Evidence

This is the most crucial step. I’ll break it into three steps for you to understand better.

Gather Evidence

For eligibility, you must prove that the procedure is medically necessary through a report from a general practitioner (GP) and a specialist surgeon. I always advocate for patients to consult a general practitioner first and get their referral before seeing a specialist surgeon.

The GP will complete a medical report documenting the acute/chronic pain resulting from the excess skin tissue on the arms. After meeting with your GP, book a consultation with me or a specialist surgeon of your choice for further examination. I’ll further assess your eligibility for an arm lift and document the symptoms and procedure. I’ll also provide you with a price quote.

The GP and the specialist surgeon should complete the medical report form for your submission with other support documents. You can access the form from the ATO website through your MyGov portal.

Supporting Documents Required

You will need to have the following documents:

- A medical report from your GP and myself (your specialist surgeon) validating the procedure is a medical necessity. This is written on the application form from the ATO.

- A copy of the procedure’s price quote, itemised and on the specialist surgeon’s letterhead. Moreover, there are also additional documents for your specialist surgeon and GP to submit to ATO.

- All costs that you are looking to cover including Hospital and anaesthetist. My patient coordinator can help you with this.

Step 3. Submit Application and Evidence to the Australian Taxation Office

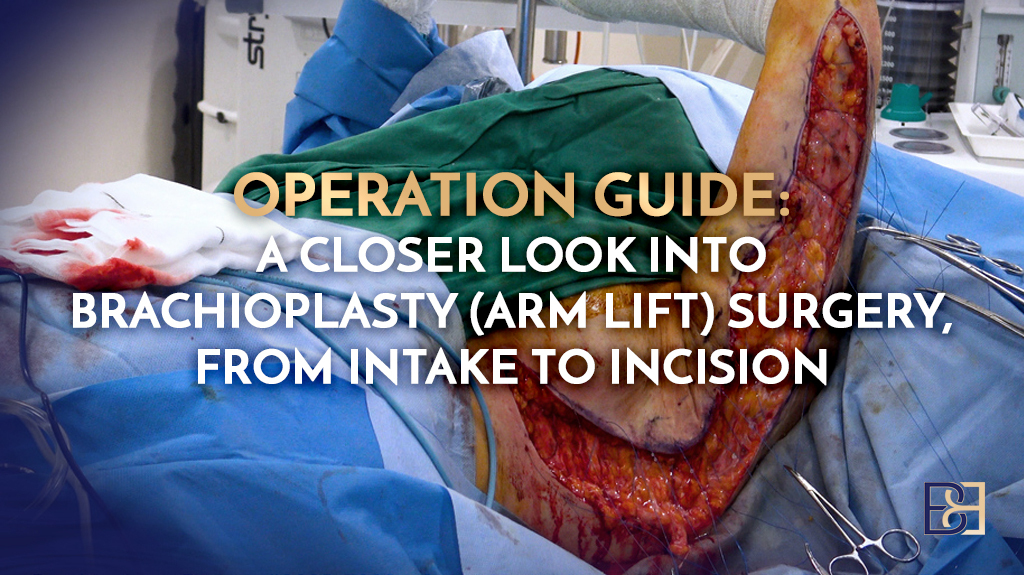

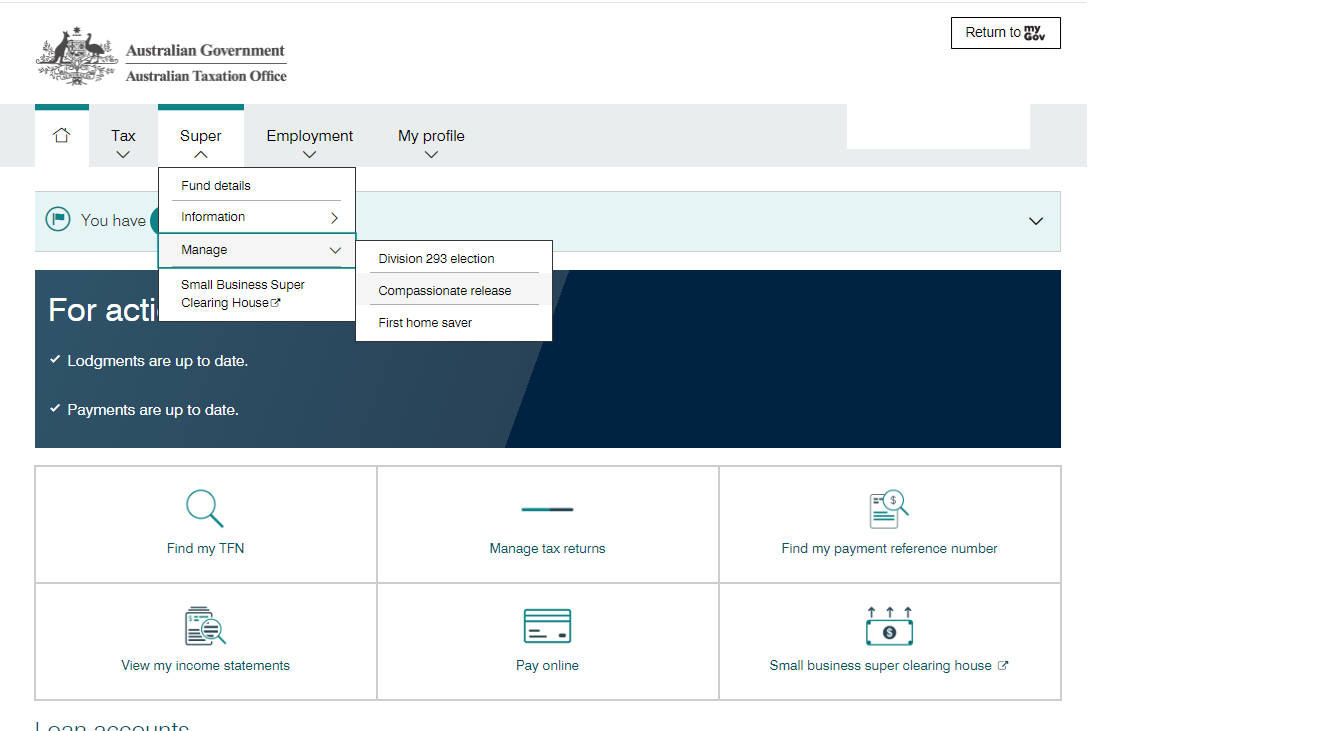

To submit your application, log in to your myGov account, which is linked to the ATO online services. After accessing the ATO online services page, select SUPER > MANAGE > COMPASSIONATE RELEASE OF SUPER and complete the online application.

Rules for Submission

When submitting your request, you need to follow these to the letter for the submission to be valid.

- The format for digital copies should be jpeg, png, gif, or pdf. ATO doesn’t accept Google documents, emails, text messages, or screenshots.

- The attachments should not exceed 20, each with at most 10 MB.

- Medical reports and price quotes must appear on a letterhead bearing the medical provider’s details, including contacts.

- Documents should be in English.

- Provide evidence of the dependent if they are the beneficiary.

- For physical application, only submit copies of the documents and not the originals.

- Receipt of Approval or Rejection Letter

After a successful application, you’ll receive ATO feedback after around 2 weeks. The ATO may contact your medical provider to validate the claims during this period. They may also request additional evidence; therefore, I always advise patients to provide all the required documents at the start to speed up the process. The ATO may approve or reject your application by sending a notification to your myGov inbox. You can appeal to the ATO within 14 days if your application is rejected.

Contact Your Super Fund to Release the Funds

After ATO approves your application, you will need to contact your own super fund to release the funds. Ensure you submit a copy of the approval letter from ATO. The super fund will then release the funds with all the applicable fees deducted. It’s important to note that this is not an overnight process and may take time.

Advice From Dr. Beldholm

Applying for early compassionate release of super funds to cover your brachioplasty (arm lift) surgery is possible but challenging. Therefore, I always advise my patients to be fully prepared and gather the required evidence before making a claim. In addition, it’s always better to wait until ATO approves your claim and your super fund releases the funds before undergoing the procedure. You can contact me (Dr. Bernard Beldholm) if you require additional information.

References

- Nagrath, N., & Winters, R. (2023). Brachioplasty. In StatPearls. StatPearls Publishing.

- Sisti, A., Cuomo, R., Milonia, L., Tassinari, J., Castagna, A., Brandi, C., Grimaldi, L., D’Aniello, C., & Nisi, G. (2018). Complications associated with brachioplasty: a literature review. Acta bio-medica : Atenei Parmensis, 88(4), 393–402.

- Chowdhry, S., Elston, J. B., Lefkowitz, T., & Wilhelmi, B. J. (2010). Avoiding the medial brachial cutaneous nerve in brachioplasty: an anatomical study. Eplasty, 10, e16.

- Aljerian, A., Abi-Rafeh, J., Ramirez-GarciaLuna, J., Hemmerling, T., & Gilardino, M. S. (2022). Complications in Brachioplasty: A Systematic Review and Meta-Analysis. Plastic and reconstructive surgery, 149(1), 83–95.

- https://www.ato.gov.au/individuals-and-families/super-for-individuals-and-families/super/withdrawing-and-using-your-super/early-access-to-super/access-on-compassionate-grounds

- https://www.ato.gov.au/individuals-and-families/super-for-individuals-and-families/super/withdrawing-and-using-your-super/early-access-to-super/when-you-can-access-your-super-early

- https://www.ato.gov.au/individuals-and-families/super-for-individuals-and-families/super/withdrawing-and-using-your-super/early-access-to-super/access-on-compassionate-grounds/how-to-apply-for-release-on-compassionate-grounds

- https://my.gov.au/

- https://www.ato.gov.au/individuals-and-families/super-for-individuals-and-families/super/withdrawing-and-using-your-super/early-access-to-super/access-on-compassionate-grounds/access-on-compassionate-grounds-what-you-need-to-know#